Indicators on Transaction Advisory Services You Need To Know

Table of ContentsTransaction Advisory Services Things To Know Before You Get ThisThe Greatest Guide To Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedSome Known Incorrect Statements About Transaction Advisory Services A Biased View of Transaction Advisory Services

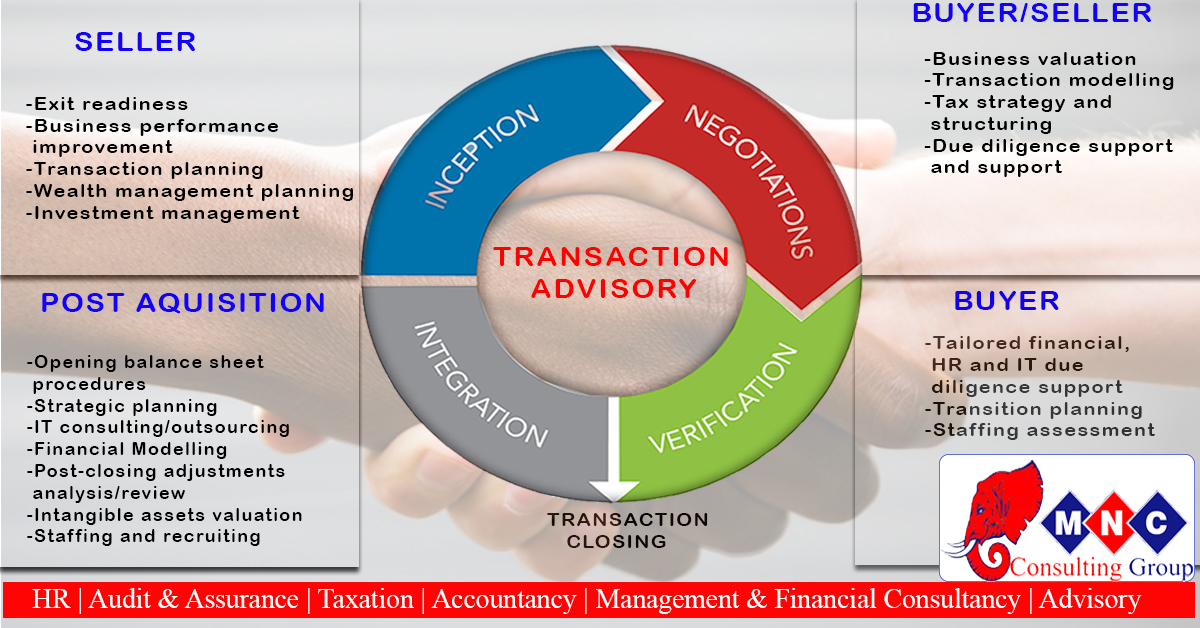

This step makes certain the organization looks its finest to potential purchasers. Obtaining the company's value right is crucial for an effective sale.Transaction advisors action in to help by getting all the required info arranged, addressing inquiries from purchasers, and preparing brows through to business's place. This builds trust with customers and maintains the sale relocating along. Getting the most effective terms is essential. Purchase consultants utilize their experience to aid local business owner deal with challenging negotiations, fulfill purchaser assumptions, and framework deals that match the proprietor's goals.

Meeting lawful policies is essential in any company sale. Purchase advisory solutions deal with lawful professionals to create and examine contracts, arrangements, and various other legal papers. This minimizes dangers and ensures the sale adheres to the regulation. The duty of deal experts prolongs past the sale. They help entrepreneur in planning for their next steps, whether it's retired life, starting a brand-new endeavor, or managing their newly found wealth.

Purchase experts bring a wide range of experience and expertise, making sure that every facet of the sale is managed properly. Via critical preparation, appraisal, and settlement, TAS aids service proprietors accomplish the greatest possible list price. By ensuring legal and regulatory compliance and handling due diligence along with various other deal team members, purchase advisors lessen possible dangers and obligations.

Transaction Advisory Services Can Be Fun For Anyone

By comparison, Huge 4 TS teams: Work with (e.g., when a prospective customer is conducting due persistance, or when a deal is closing and the buyer needs to incorporate the business and re-value the vendor's Balance Sheet). Are with costs that are not connected to the bargain closing successfully. Gain fees per engagement someplace in the, which is less than what investment financial institutions make also on "tiny bargains" (however the collection probability is likewise much higher).

The meeting questions are extremely comparable to investment financial interview concerns, but they'll concentrate more on audit and assessment and much less on topics like LBO modeling. Expect inquiries about what the Modification in Working Funding methods, EBIT vs. EBITDA vs. Web Earnings, and "accountant just" subjects like trial balances and exactly how to stroll with occasions using debits and debts instead of financial statement modifications.

The Only Guide for Transaction Advisory Services

Specialists in the TS/ FDD teams might additionally interview monitoring concerning everything above, and they'll create an in-depth report websites with their findings at the official website end of the procedure.

, and the basic form looks like this: The entry-level role, where you do a great deal of information and monetary analysis (2 years for a promo from here). The following degree up; similar work, however you get the more interesting little bits (3 years for a promo).

In specific, it's difficult to obtain promoted beyond the Supervisor degree since few individuals leave the job at that stage, and you require to start showing proof of your capacity to produce income to advancement. Let's begin with the hours and way of living given that those are much easier to describe:. There are periodic late evenings and weekend job, however nothing like the agitated nature of financial investment banking.

There are cost-of-living modifications, so expect reduced compensation if you remain in a more affordable location outside major economic centers. For all placements except Companion, the base pay makes up the mass of the total compensation; the year-end benefit may be a max of 30% of your base pay. Often, the ideal means to increase your incomes is to switch to a different company and bargain for a higher income and reward

The Ultimate Guide To Transaction Advisory Services

At this stage, you should simply stay and make a run for a Partner-level duty. If you desire to leave, perhaps move to a client and do their assessments and due diligence in-house.

The main trouble is that since: You normally require to sign up with one more Big 4 group, such as audit, and work there for a couple of years and after that move into TS, work there for a couple of years and afterwards move right into IB. And there's still no warranty of winning this IB function since it read this depends on your area, clients, and the hiring market at the time.

Longer-term, there is additionally some danger of and because reviewing a firm's historical financial details is not precisely brain surgery. Yes, human beings will always require to be involved, yet with more advanced modern technology, lower head counts could potentially sustain customer engagements. That stated, the Transaction Providers group beats audit in regards to pay, job, and departure opportunities.

If you liked this write-up, you may be interested in analysis.

The Ultimate Guide To Transaction Advisory Services

Develop advanced monetary structures that assist in determining the real market price of a company. Give advising operate in connection to service assessment to assist in bargaining and rates structures. Explain the most ideal type of the deal and the sort of factor to consider to utilize (cash, stock, earn out, and others).

Develop activity plans for risk and direct exposure that have actually been determined. Carry out integration preparation to identify the process, system, and business modifications that may be called for after the bargain. Make numerical quotes of assimilation costs and benefits to analyze the economic rationale of combination. Establish guidelines for incorporating departments, technologies, and business processes.

Evaluate the prospective consumer base, industry verticals, and sales cycle. The operational due diligence uses crucial understandings right into the performance of the firm to be obtained concerning threat evaluation and value production.